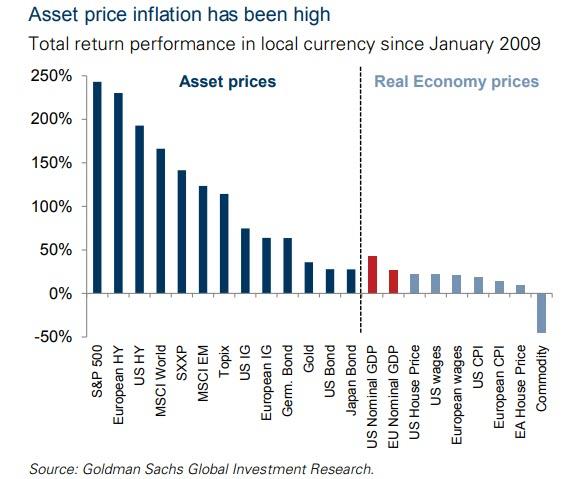

Let’s be nice and say that the money supply has tripled since 2020. Prices have risen by about 30% by now. Which means that the inflation will be here for quit a while longer. A simple case of too much money chasing too few assets.

I expect the prices for the basic necessities like food and rent will more than double before we reach the end of the transitory phase.

Inflation is really ALWAYS transitory. Many people think that even the universe is transitory.

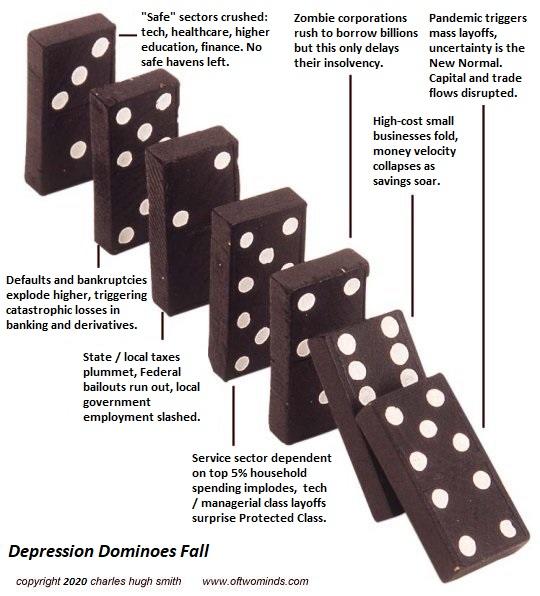

You know it by know. We are fucked.